Super Micro joining S&P 500 after 20-fold jump in stock in two years

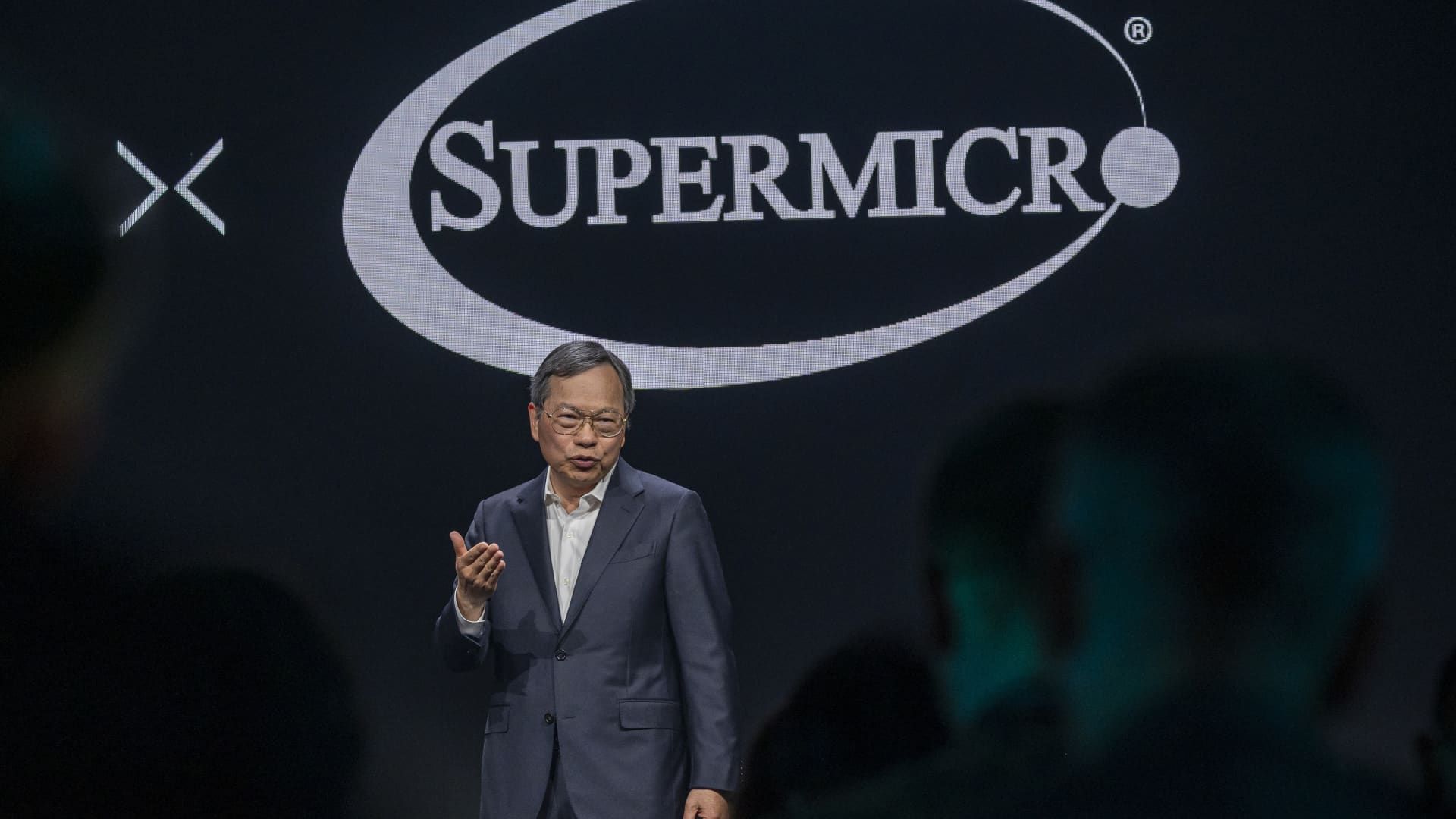

David Paul Morris | Bloomberg | Getty Images

Super Micro Computer is joining the S&P 500 following a historic rally in the stock that has pushed the company’s market cap past $50 billion.

The shares, up more than 20-fold in the past two years and over 200% just since the start of 2024, climbed another 8% in extended trading on Friday.

Super Micro is replacing Whirlpool, according to a press release. Deckers Outdoor is also joining the S&P 500, replacing Zions Bancorporation.

Stocks added to the benchmark index often rise in value because funds that track the S&P 500 will add it to their portfolios. The median market cap for companies in the S&P 500 is $33.7 billion.

Super Micro has been one of the main beneficiaries of the artificial intelligence boom sweeping the technology industry. The company makes servers and other computer infrastructure, and it’s one of the primary vendors for building out Nvidia-based “clusters” of servers for training and deploying AI models.

In the quarter that ended December, Super Micro’s revenue more than doubled to $3.66 billion. Analysts expect sales in the current quarter to more than triple.

“We see Nvidia’s results as a positive data point for SMCI which is one of the leading partners that designs and manufactures servers to wrap around the GPUs and customizes racks to the specific needs of a customer,” Bank of America analyst Ruplu Bhattacharya wrote in a note last month. He has a buy rating on the stock.

Don’t miss these stories from CNBC PRO:

Read the original article here