Redwire expands into defense with $925 million purchase of Edge Autonomy

WASHINGTON — Redwire announced a deal to acquire drone maker Edge Autonomy for $925 million, a combination that would transform the space infrastructure company into a bigger player in defense technology.

Jacksonville, Florida-based Redwire announced Jan. 20 it will pay $150 million in cash and $775 million in stock for Edge Autonomy, a manufacturer of military uncrewed aircraft systems whose technology has been deployed with Ukrainian forces in their war against Russia.

The deal represents a major pivot by Redwire into the defense technology sector, underscoring the growing focus on autonomous warfare capabilities for military operations.

The acquisition is expected to close in the second quarter of 2025 pending shareholder and regulatory approvals. Once completed, California-based Edge Autonomy and its subsidiaries will operate as wholly-owned entities under the Redwire umbrella.

Strategic move into defense

Peter Cannito, Redwire’s chairman and CEO, highlighted the strategic significance of the merger during a call with analysts Jan. 21.

He noted that the acquisition positions Redwire to capitalize on one of the hottest areas of the defense market — autonomous warfare driven by drones and artificial intelligence.

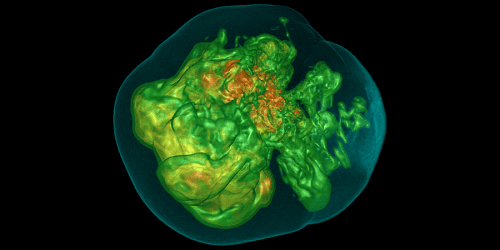

By combining Redwire’s expertise in low-earth orbit (LEO) satellites with Edge Autonomy’s advanced drone technology, the company aims to create integrated command-and-control networks that cater to military operators. Cannito emphasized the “multi-domain” potential of this merger, bridging the gap between airborne and space-based systems.

Redwire, founded in 2020 by the private equity firm AE Industrial Partners, has pursued an aggressive acquisition strategy in the space and tech sectors, but this deal stands out due to its size and its strategic expansion into defense. The combined company would generate over $500 million in annual sales. Redwire had revenues of $298 million and Edge Autonomy of $222 million over the past 12 months.

Cannito anticipates that roughly 50% of the merged entity’s revenue will come from U.S. and international defense contracts, with the remainder from commercial and civil space ventures.

He noted international growth opportunities, particularly in Europe, where Edge Autonomy has seen significant success in recent years. However, Cannito tempered expectations for 2025, citing uncertainty around Ukraine’s ongoing conflict with Russia.

Aligning with Pentagon priorities

For Redwire, which opened a national security-focused facility in Chantilly, Virginia, last year, the acquisition delivers on Cannito’s previously stated plans to expand the company’s defense portfolio.

Recent U.S. Department of Defense strategies emphasize the importance of multi-domain operations — coordinated efforts across land, sea, air, space and cyber domains — and the rising demand for joint all-domain command-and-control technologies.

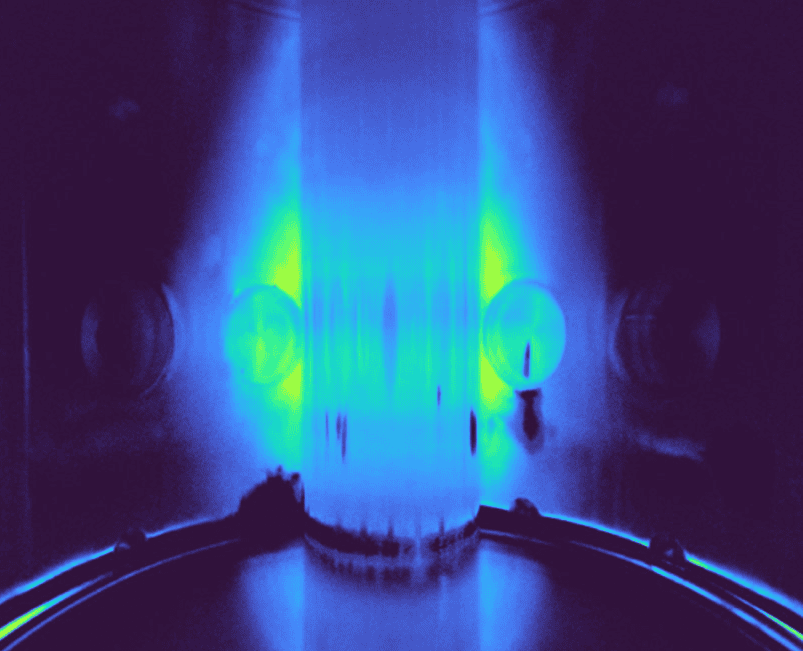

Founded in San Luis Obispo, California, Edge Autonomy employs more than 600 people and operates across six locations in the U.S., Canada, and Europe. One of its uncrewed aerial systems (UAS), called the Penguin, was provided to Ukraine as part of recent U.S. military aid packages.

Edge Autonomy’s drone technology incorporates edge computing and AI, allowing for real-time data processing, autonomous navigation and collaborative swarm capabilities. Experts says these features enable faster decision-making and enhanced situational awareness on the battlefield.

A central focus of the merger is the synergy between Edge Autonomy’s tactical drones and Redwire’s low-flying satellites dubbed “orbital drones,” designed for very low earth orbit. These systems aim to create a seamless network of autonomous platforms, from the ground to space.

“As space and airborne platforms converge into an integrated network of autonomous, collaborative systems, Redwire will be poised to provide end-to-end solutions for multi-domain operations,” Cannito said.

Related

Read the original article here