Bruno trumpets transformation of ULA after Vulcan launch

ORLANDO, Fla. — As rumors of a potential sale of United Launch Alliance reach a crescendo, the company’s chief executive argues the successful inaugural launch of its Vulcan rocket is a vindication of both the company’s technology and its transformation.

Speaking at the SpaceCom conference here Jan. 31, ULA Chief Executive Tory Bruno said the long-delayed first flight of its Vulcan Centaur rocket Jan. 8 went exceedingly well, with no issues reported during the countdown or after liftoff.

“That was a perfect mission,†he said of the launch, which placed Astrobotic’s Peregrine lunar lander on a highly elliptical lunar transfer orbit. “Dead nominal flight throughout, and a bullseye insertion in the end.â€

That was in contrast with the reputation first launches of new vehicles have, which historically have high failure rates. “I’ve done about three dozen first launches, and generally one of two things happen: either it blows up or it has significant anomalies in flight,†he said. “I have never seen as clean a first launch†as Vulcan.

He credited that to ULA’s approach to designing the rocket. “You can fly, fail, fix; nothing wrong with it,†he said. ULA instead took a “rigorous design process: have your failures in ground tests, have them in the computer, have them in the sim lab and have them on paper. That’s how this was done and my guys just did an outstanding job.â€

Another factor, he argued, was a transformation of the company he led after joining the company in 2014. He described the company then as one in crisis, having lost access to Russian-built RD-180 engines used by the Atlas 5 after Russia’s annexation of Crimea as well as competition from SpaceX, which sued the U.S. Air Force to gain access to national security launches that ULA then held a monopoly on.

“A business in that situation might go broke. In fact, most of them do,†Bruno said. He undertook several measures to turn the company around, from reducing costs and changing the company’s product line to more commercial approaches and accepting it will have to compete. “The plan was we were going to shrink and become competitive and then we’re going to grow.â€

That approach, which included laying off a third of the company’s workforce while investing in development of Vulcan, was key to winning the largest share of the National Security Space Launch (NSSL) Phase 2 contracts in 2020. “That saved us. Now we’re not going out of business.â€

A high-energy future

The future of ULA has been the subject of widespread industry discussion. The company is currently jointly owned by Boeing and Lockheed Martin, having been formed as a joint venture of those companies’ launch businesses in 2006. However, Boeing and Lockheed have been weighing proposals to sell ULA.

Industry sources say a deal to sell ULA could come as soon as this month. The two leading prospective buyers are Blue Origin, which is developing the rival New Glenn launch vehicle but also supplies BE-4 engines for ULA’s Vulcan, and private equity fund Cerberus Capital Management. Defense contractor Textron has also been linked to those sale discussions but is rumored to no longer be in the running.

Bruno did not address a potential sale of ULA in his remarks. However, some attendees noted privately that the speech had elements of a pitch a company might give to prospective buyers, emphasizing its turnaround and its capabilities, and perhaps to suggest to them that he be retained as chief executive after the sale.

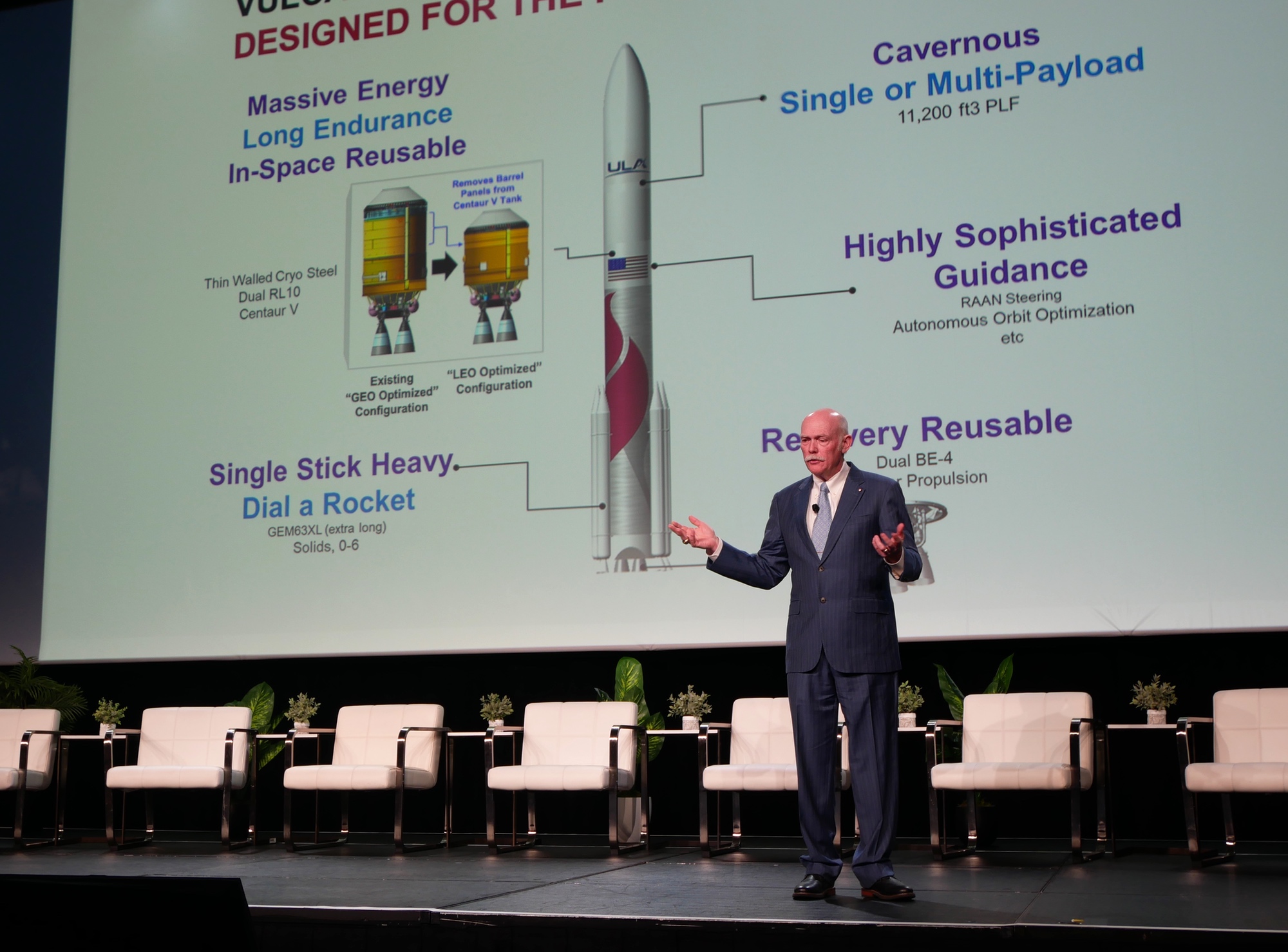

Bruno, for example, argued that the company was uniquely positioned to serve national security markets with its “high-energy†Vulcan. “When Atlas flies out in about a year, this will be the only high-energy rocket left in the world,†he said, serving “the most critical and important missions, unique missions, for national security.â€

That approach, he said, was proven with the NSSL Phase 2 contracts. “There’s a lot of high-energy missions in there and we designed for that,†he said, such as missions that involve direct injection of payloads into geostationary orbit, which he said will be a growing share of both Phase 2 and the upcoming Phase 3 contracts.

“We run about 34% cheaper on a high-energy mission than the other one, SpaceX, does,†he argued. “We put all our bets nine years ago in the right places.â€

He contrasted Vulcan with “low-energy†rockets he argued are “hyperoptimized†for launching low Earth orbit spacecraft. “Don’t be one of those crazy fanboys who has a favorite rocket,†he said. “A rocket is an engineering machine that is targeted at a specific task and is best at that, and not quite best at other things.â€

Yet, ULA’s largest customer for Vulcan is Amazon’s Project Kuiper, a LEO constellation, having acquired 38 launches that account for about half of the current backlog of more than 70 Vulcans. “To sell 38 was remarkable,†he said, particularly since Vulcan had yet to fly when the contract was announced in April 2022. The other two vehicles Amazon selected then, Arianespace’s Ariane 6 and Blue Origin’s New Glenn, also had yet to fly at the time.

He didn’t linger on the apparent contradiction of Vulcan relying on LEO business, emphasizing instead a diversified manifest. “You’re not healthy if you only support the government. You’ve got to have some commercial,†Bruno said. The share of ULA business that goes to U.S. government customers, he noted, has gone down from 76% before Bruno arrived to 41% today.

“We transformed. We shed our skin. We completely changed the company to become what is needed of us now,†he concluded. “I’m sure glad we didn’t go broke in 2017.â€

Related

Read the original article here