Constellation primetime is MDA’s time to prime

Canada’s MDA has traditionally taken the backseat in non-geostationary orbit (NGSO), supplying antennas and other satellite components as a subcontractor to smallsat megaconstellation specialists.

That changed after being carved out of Maxar Technologies in 2020 as an independent company.

The deal enabled MDA to invest in mass manufacturing capabilities and a new software-defined satellite that could be reprogrammed in orbit, putting it on course to become a constellation prime as the industry shifted in favor of builders with payload expertise.

MDA got its big break just two years later with a 2022 contract to build Globalstar’s third-generation low Earth orbit (LEO) network, bankrolled by Apple to help keep 1.5 billion active iPhone users connected to emergency services even when they can’t get a cell signal.

In August, Telesat became the first customer for MDA’s digital satellite product with a 2.1 billion Canadian dollar ($1.6 billion) contract to develop the Lightspeed LEO broadband constellation — MDA’s largest contract since its founding nearly 55 years ago as MacDonald, Dettwiler and Associates.

Before the end of 2023, MDA announced it was also working with an unnamed customer looking to use the digital satellite design for an NGSO project shrouded in secrecy.

Alongside a business best known for the robotic space arms that helped assemble the International Space Station and the Radarsat imaging satellites it operates from geostationary orbit (GEO), MDA is busy upgrading production facilities in Montreal to build two satellites a day for its NGSO constellation future.

That’s faster than it needs to deliver 17 satellites for Globalstar, 198 for Telesat, and 36 for an unnamed GEO customer starting in 2025.

But at two a day, MDA Mike Greenley says the company could handle 400 satellites a year and 2,000 over a five-year period.

This scale underlines the opportunity MDA sees for this new business line, and a lot is riding on reaching its production throughput goals.

“That’s our one trick,†Greenley says, “we just got to do it well and get it all set up properly.â€

SpaceNews caught up with Greenley to learn more about MDA’s constellation transformation.

What attracted MDA to the mass manufacturing constellation business?

For years and years, we were delivering antennas, electronics, and payloads to satellites for GEO. We supplied all the large manufacturers of geosynchronous satellites, and that was our business. When LEO came along as a new opportunity over the last decade, it came alongside a big shift in the manufacturing business.

It used to be that the people who built the satellites had a bus and were the satellite prime — you would put the payload in the bus they had the solution for. Over the last several years, especially with the advances in communication satellites — and certainly now with digital satellites — the payload is the main thing. It is increasingly the most complex part of the system and the largest part of the satellite budget. You need a bus, but you can buy a bus from somebody, or have your own bus design, but the payload is the crux of it all.

And so there’s been a shift in terms of the payload provider becoming the prime. We’ve developed payloads for all the different communication bands used in satellites, and it was just the next logical step for us to start becoming satellite prime.

You’ve only just started out and yet announced three constellation projects in less than two years.

In country music, they’ll say someone’s an overnight success, but they spent the last decade in Nashville singing in all the bars. We’ve been building incremental capability over the years on LEO constellations we’ve supplied, including O3b, Iridium, and OneWeb.

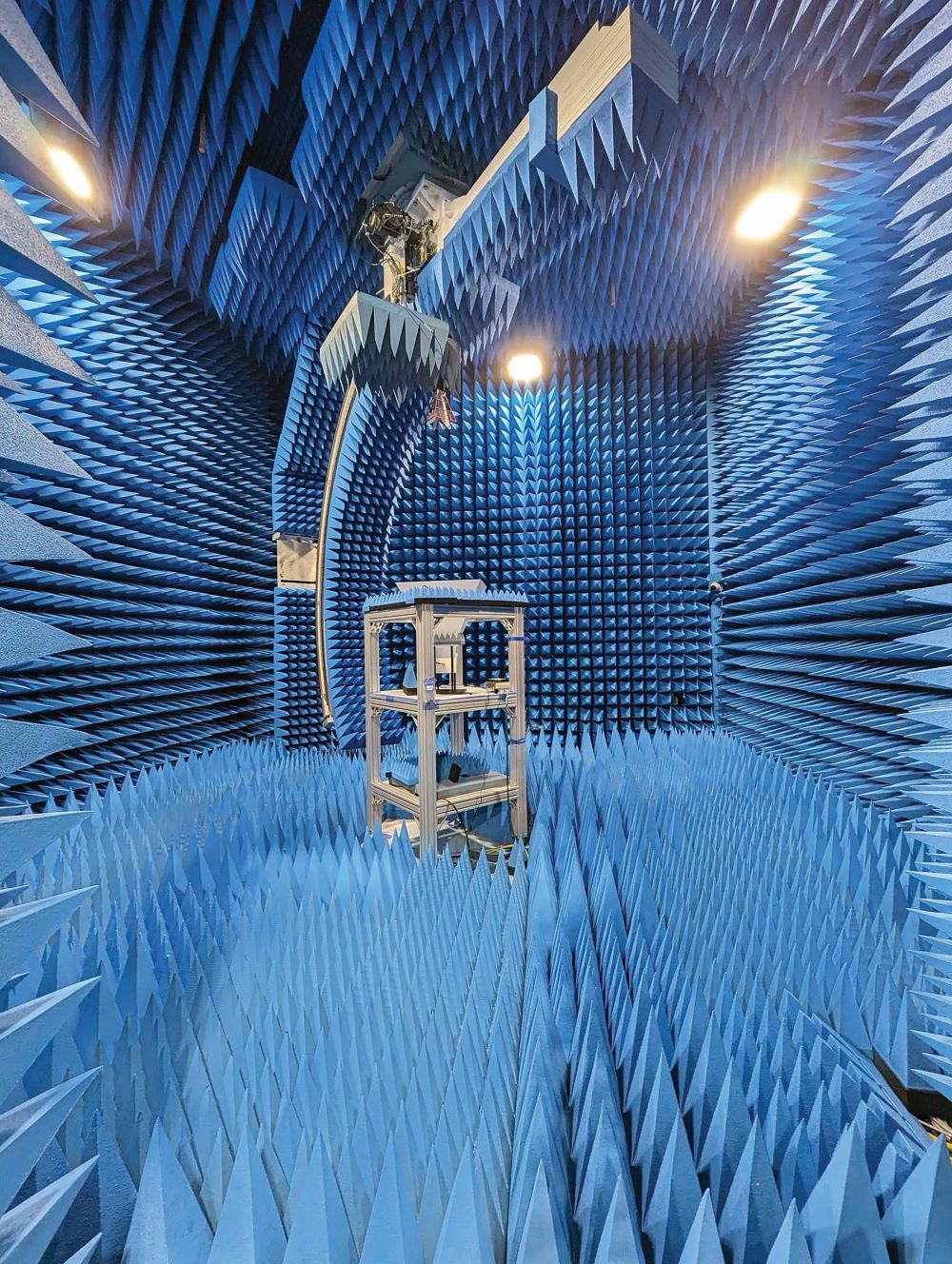

Delivering subsystems in increasing volumes for these constellations allowed us to mature our capabilities. Delivering 2,500 antennas for OneWeb caused us to adjust to additive manufacturing, using far fewer components and 3D-printing, and then advanced manufacturing — introducing assembly and robotics-based testing cells so our workforce and our robotic systems were working together to produce high volumes at speed to high levels of consistent quality.

We’ve occasionally also delivered full satellites over the years, so when we spun out of Maxar four years ago, people suddenly started calling about quotes for delivering full satellites. We started bidding and won the opportunity with Globalstar and their customer Apple, which got us on our way.

Meanwhile, you have been developing satellites with digital payloads.

We’ve been doing that for years, and it hit primetime at the same time as we started working on full satellites. We were able to come forward with Telesat and the unnamed customer we announced last fall with a new product, which we could deliver quickly and at high volumes in high quality.

Success begets success, and once you have a hit record, people want to hear the next one. So, the conversations continue as we get the chance to talk to a number of different constellations in the market.

It’s great having an anchor customer in Telesat with 200 satellites. That’s the best possible position to bring a new product to market, bring it into high-volume production, bring a supply chain along with you, and then you’re absolutely ready to go for the next customer wanting to have a conversation.

What can you say about the work with your unnamed NGSO customer?

What we announced was an Authorization to Proceed (ATP), which allows us to complete some engineering work that we need to do as a team and order some of the long lead parts to ensure that we are ready to hit an aggressive schedule.

Will it be a LEO network, and when could it launch?

We’re not talking about that yet. It’s still called an NGSO in public. It could be medium Earth orbit (MEO) or LEO. That’s all we’re saying to respect the relationship with the customer. From a business and publicly traded company perspective, it was important to explain what we were doing as we were out in the market buying equipment and working on things beyond what we had announced.

When is the start of mass production for Telesat Lightspeed?

That will pick up pace in the second half of 2025. Telesat needs a few satellites in 2026; the rest will go up in 2027. So we’ll complete our higher volume production capability and gradually ramp up.

We’re creating capacity to produce this new product at a rate of up to two satellites a day. We don’t need that necessarily for Lightspeed, but the capacity will allow us to serve multiple constellation customers at a time.

What satellite production rate was previously possible?

Traditional bespoke single GEO satellite integration typically takes nine to 12 months, depending on the satellite configuration. A single small satellite flowing through our high-volume production facility will be integrated in less than 20 working days.

When do you think you’ll hit that two-a-day rate?

We’re going through this factory modification right now, and it’ll have to be completed by the end of 2025 to hit our schedules. As we come into 2026, we’ll be able to reach that rate if we have that much business.

We don’t have contracts requiring us to go at two satellites per day, but that is the production capacity we are setting up right now — and it won’t be set up in phases; it’ll just be set up and ready to go.

Does it also serve as a contingency capability so you can accelerate production if, for whatever reason, things fall behind?

That’s not part of the rationale, but you’re correct. If something did slip, and you weren’t using all your capacity, you can pick up the pace.

How are you managing schedule risks with three NGSO projects on the go and the others you hope to take on?

Most importantly, we are setting up this production capacity to do two satellites a day. That’s our one trick; we just got to do it well and get it all set up properly.

At that rate, you could do 400 satellites a year and 2,000 over a five-year block. We’ve got a couple hundred orders from Lightspeed and another 36 or so from one unnamed customer. So I’ve still got to get the guys to sell 1,800 more.

It’s important that people understand that because, as other orders are announced, we’re not straining the capacity. We’re just filling it up.

What kind of automation are you planning to reach this capacity?

The modifications to our Montreal site involve adding more space and creating an advanced manufacturing, assembly line environment where the satellite moves on a platform, parking at workstations to get the next steps done.

Does this level of automation reduce the need to expand the workforce?

There will always be the need to scale up workforces a little bit, but having this one production capacity we’ve mapped out will allow us to do a lot with our workforce.

There are two types of workforce: Production cells with the human and automation teams working together and the engineering workforce. There’s a lot of commonality in the designs we’re talking to existing and potential customers about, but there’s always a little bit of tweaking needed, so you need engineering capacity on each of those orders.

Are you encountering challenges in hiring skilled workers?

Not so much. It’s been hard work as we scaled — we’ve gone from 1,800 people a few years ago to around 3,000 people — but it was never a tripping point. We’ve been able to recruit really strong engineering and production capacity, and we were able to keep up.

Everybody wants engineers, but in the engineering world, a certain population thinks space is pretty cool. At MDA, whatever you work on is going to go into orbit. And it’s not some science experiment — we’re in our 55th year of producing space-quality stuff that, knock on wood, lasts five years or whatever we want in orbit. Whatever we’ve launched has worked 100% of the time. When you get to come in and work on this stuff, it’s a great career opportunity, and that really does work to our advantage.

We’ve also done some things to make sure that we are always de-risking. For example, in the fall, we acquired a small group from Satixfy. They had two groups in their company: one producing digital chips, and the other taking those chips to create digital payloads, which is what we do. So we bought the digital payload group from them in England, and we’re hiring around those people. Now, we’ve got our Quebec-based workforce and another group of digital satellite engineers growing up in the United Kingdom, opening up another recruitment tool for us.

What about the availability of parts? Have we come out the other side of pandemic-related supply chain issues that hobbled the industry in 2020?

Space is a strong and growing industrial sector, but it’s not the scale of the automotive sector, where if there’s a change in the global chip supply, everybody falls apart.

We all buy decent volumes, but it’s a niche supply chain, so the space sector generally did okay through COVID compared to many sectors. It certainly has come out the other side and continues to do well.

One of the things we are focusing on for our supply chain is, as we scale up to these types of volumes, we’re now having conversations with suppliers about whether they can scale with us — in addition to providing high-quality performance and good prices.

How many NGSO constellation projects are serious about picking a manufacturer this year?

The level of interest has definitely increased over the last five years. We have a very active NGSO constellation pipeline — over $10 billion of opportunity in terms of the people we talked to. It falls into three areas:

One area is broadband communications, like Telesat Lightspeed, providing high-speed data services to customers around the world.

A second area would be Internet of Things (IoT) connectivity, where corporations want a network to track and connect their global assets.

And then there’s direct-to-device, such as the Globalstar satellites with Apple, whereby you’re putting up a constellation to talk directly to smart devices of some kind.

And the market continues to grow. Some players are the typical satellite companies, the Telesats, Intelsats, and the Globalstars — all those companies that have historically operated space-based networks that are now looking to LEO and MEO to continue their expansion.

There are new players raising money that feel they have a business case and anchor customers to launch their own space-based networks as a new business type.

And then there are corporations that are now starting to look to global networks as a key aspect of their business. It could be agricultural products, a car manufacturer that wants to have smart or autonomous cars, or appliance companies that want to connect their smart offerings to the world.

For a multinational, it’s pretty affordable now to have a space-based network that connects all your assets globally to offer customers a new level of capability or to convert to more of an as-a-service model. People can buy cars, farm equipment, whatever it is, and then add services to turn features on and off, add new data products and information to increase the accuracy and performance of that object worldwide.

Are these multinationals part of that $10 billion opportunity you have identified?

Yes, corporations have announced that they’re looking to build their own networks. They’re out talking to people about where they will get their satellites. In addition, some corporations are talking to the historical communication network providers because they would rather buy communications as a service.

However, some corporations want to have their own constellation to fully control their network.

John Deere recently announced a partnership to use SpaceX’s Starlink satellites. Who else is out there?

Porsche Volkswagen announced a couple years ago they had put a couple billion euros aside to consider a space network. I’m not aware of the status of that network, but there was chatter about that.

And there are others that have not been announced?

There’s other people that poke around, for sure. There’s opportunity for global connectivity that gets to everybody and is less complicated than trying to do it terrestrially. There’s still a third of the world that is not connected to the internet, so to throw up a space network and connect to everybody is a meaningful thing.

And yeah, people might spend $1-2 billion doing that, but for a large multinational corporation that’s not a crazy investment level when you get to massively advance the state of your business.

MDA is currently set up to build 600- to 1,000-kilogram satellites. Do you see demand that could push you toward larger or smaller satellites, and what about GEO and beyond?

There will always be GEO satellites, but that global market has transitioned from peak years of 20 to 22 satellites to single digits. I don’t think we’ll find ourselves there. We’re an NGSO satellite manufacturer. That’s where the market is. That’s where there’s volume and new opportunity.

The kilogram range you’re talking about seems to be the sweet spot, so that’s our focus.

What about other acquisitions following Satixfy to build out capability?

We always keep an eye on M&A opportunities, but they have to fit our strategy: No. 1 for us is organic growth, which we have been maximizing for a couple of years. No. 2 would be tuck-in M&A to de-risk our ability to grow organically — our acquisition of Satixfy’s digital payload group was an example. No. 3 would be M&A for scale, which we see will be an opportunity over the next several years.

This interview has been edited for clarity and length.

This article first appeared in the February 2024 issue of SpaceNews magazine.

Related

Read the original article here