Japanese satellite order puts GEO market on par with 2023

TAMPA, Fla. — A communications satellite order from Japan’s flagship operator has brought the geostationary orbit (GEO) market back to par with last year.

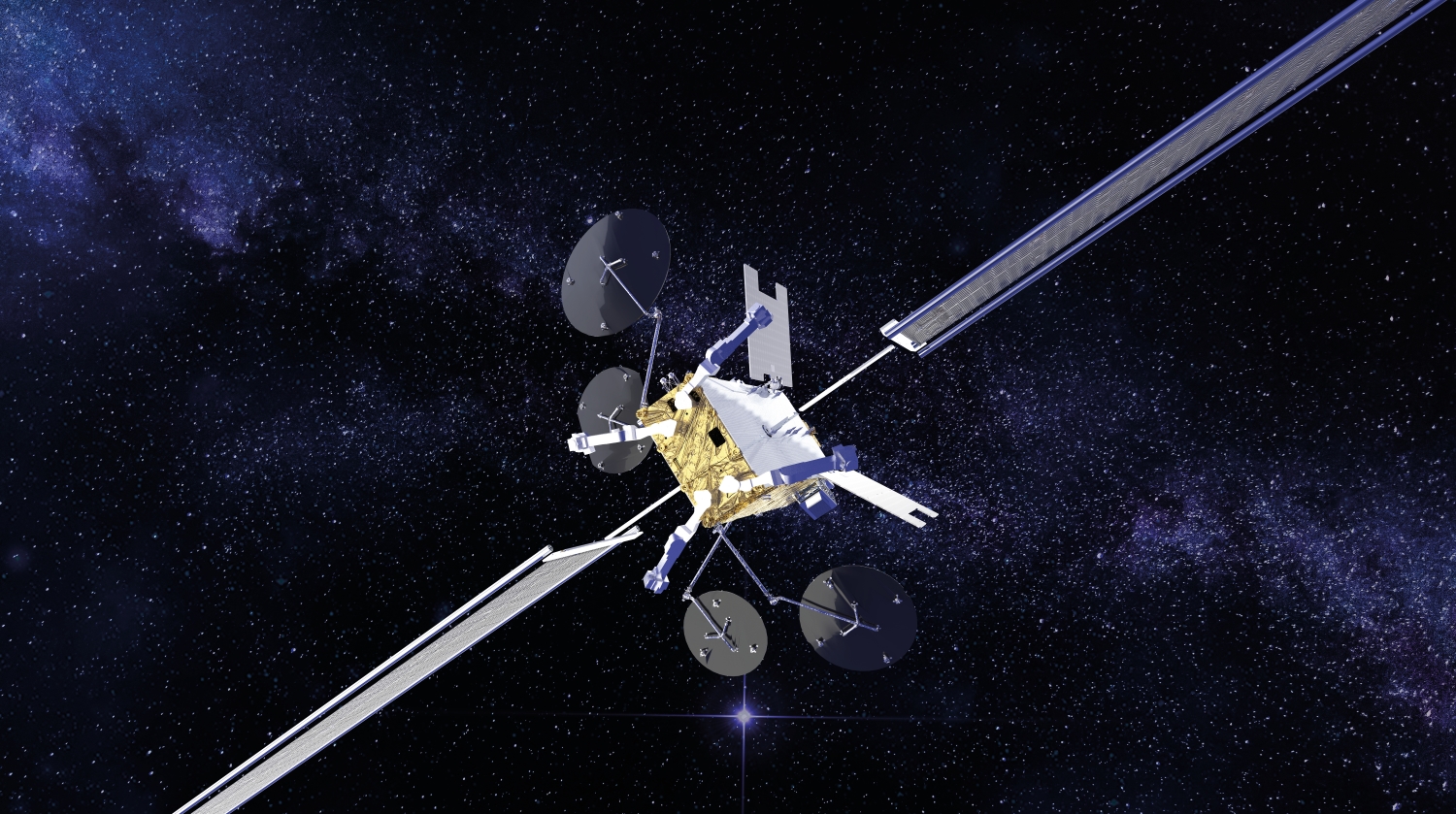

SKY Perfect JSAT said May 27 it had ordered the JSAT-31 satellite from Europe’s Thales Alenia Space for a launch in 2027 to provide broadband across Japan, Australia, New Zealand, Southeast Asia and the Pacific islands.

JSAT-31 will be based on Thales Alenia Space’s software-defined Space INSPIRE (INstant SPace In-orbit REconfiguration) platform, which would enable the operator to adjust its Ka and Ku-band capacity while in GEO to meet changing mission needs.

Eiichi Yonekura, SKY Perfect JSAT’s president and CEO, said JSAT-31 would have around 50 gigabits per second of capacity, the largest in its fleet of 17 satellites.

JSAT-31 is the 31st satellite SKY Perfect JSAT has procured in its more than 30-year history — and its first from Thales Alenia Space, a joint venture between Thales of France and Leonardo of Italy.

The operator said it has also decided to name future satellites JSAT, rather than JCSAT or Superbird.

Tracking GEO orders

The announcement follows two satellite orders in March for California’s Astranis, one from Thai fleet operator Thaicom and another from Argentina-based remote connectivity specialist Orbith.

Astranis provides dishwasher-sized satellites scaled for smaller geographies, which are cheaper and much smaller than traditional GEO spacecraft around the size of a school bus.

Spacecraft for Thaicom and Orbith would each have a mass of around 400 kilograms, while Space INSPIRE from Thales Alenia Space would come in at around 2,000 kilograms.

There were also three orders for commercial GEO communications satellites by this time last year.

Two were announced in March 2023 for Astranis, and another was announced a month later based on the Maxar 1300 series platform, the largest in Colorado-based Maxar Technologies’ product line with a mass of up to 6,800 kilograms.

Last year closed out with 10 orders for commercial GEO communications satellites, according to NovaSpace (formerly Euroconsult) figures.

Although roughly in line with 2022 and 2021, manufacturers used to vie for 15-20 large orders annually before the rise of low Earth orbit broadband constellations.

Operators are increasingly opting for smaller GEO spacecraft or more flexible payloads to derisk their investments amid market uncertainty, NovaSpace consultant Alix Rousselière said.

“The consolidation seen in the industry is another factor that limits new orders as there are fleet replacement synergies that can be achieved that way, or through partnerships,” Rousselière said via email.

SES announced $3.1 billion plans to buy fellow fleet operator Intelsat in April, less than a year after Viasat closed its multi-billion-dollar deal for Inmarsat.

Related

Read the original article here