Automate Your Savings

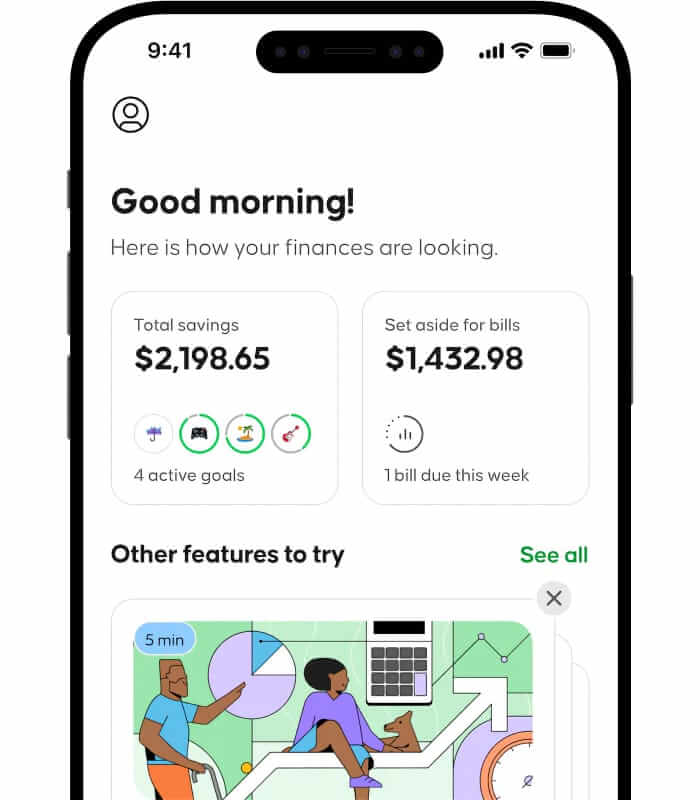

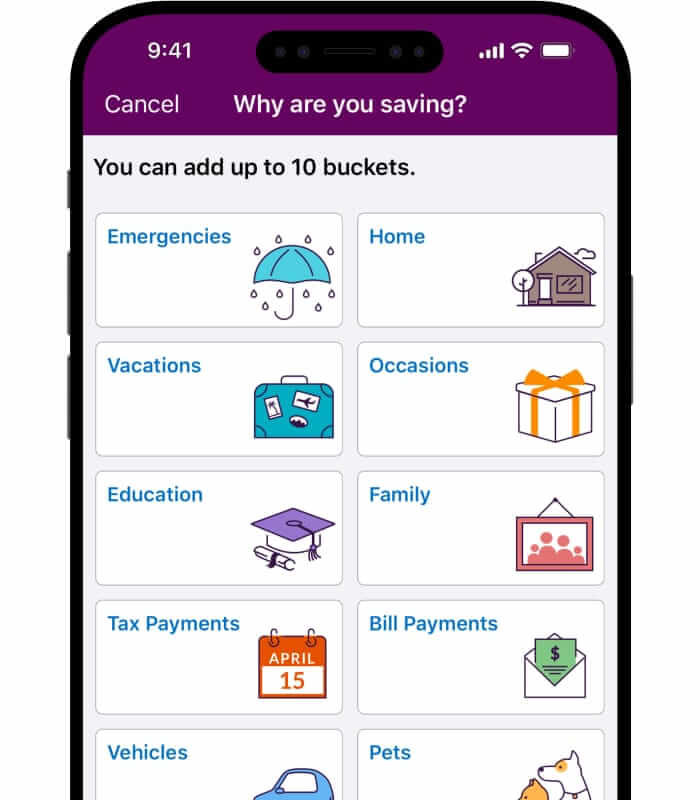

Save money without even having to think about it. This is, by far, the easiest way to ensure you’re adequately putting some money away because it removes any chance of skipping out on your responsibility. Automated deposits are simple and effective because they take money directly from your paycheck and put it into a savings account. You can also use a service or an app like Oportun or Qaptial to make saving a painless endeavor. These handy tools analyze your spending and automatically deduct small amounts from your account to help you save little by little.

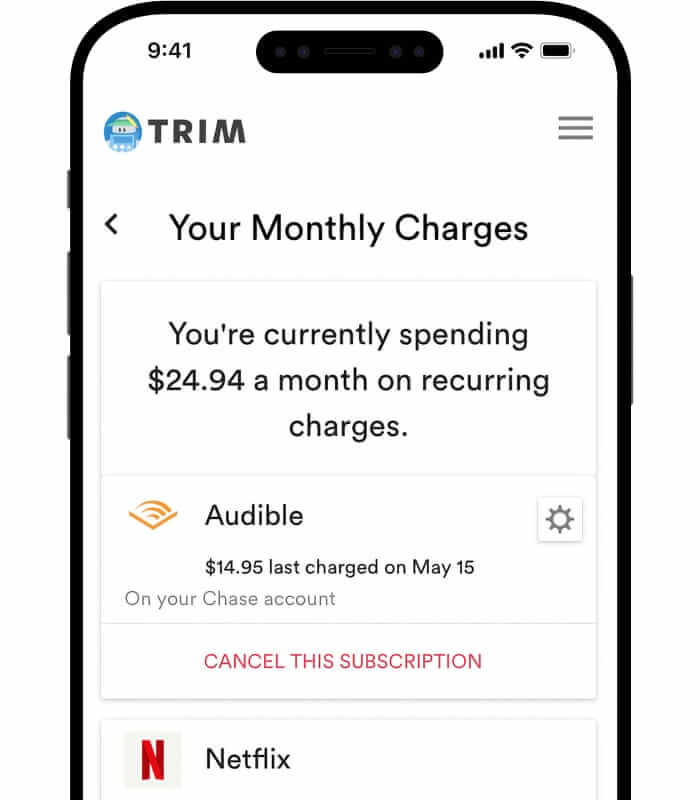

Track Your Spending

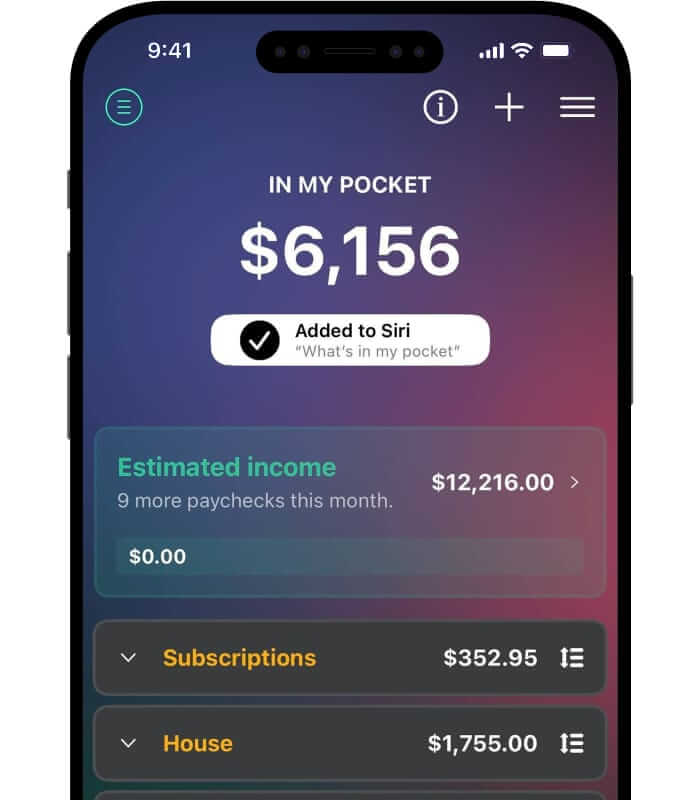

Tracking brings awareness to any situation. Whether you’re making $25,000 or $250,000 a year, financial planners will tell you that we need to understand where our money is going. You could use your phone’s note app to log what you spend throughout the day. Doing this, even for a week, will bring a heightened consciousness level to your spending. Or simply dedicate a debit card to your discretionary expenses, or even a credit card (if you commit to paying it off each month) to help you get a clear picture of how much you’re spending day-to-day on the non-essentials. Apps like PocketGuard will also tie into your bank and help categorize spending to aid in building a workable budget.