StanChart CEO says ESG is good for business

Bill Winters, Chief Executive Officer at the Standard Chartered Bank, attends a panel session of the World Governments Summit in Dubai on February 12, 2024.

Ryan Lim | Afp | Getty Images

Standard Chartered chief executive Bill Winters says environmentally conscious investing can be good for business, dismissing the impact of a U.S. crusade against mission-driven investments.

His comments come at a time when investments based on environmental, social and governance (ESG) factors have become a politically polarized issue.

In the United States, for example, Republican lawmakers have decried ESG as a form “woke capitalism” that seeks to prioritize liberal goals over investment returns.

Democratic lawmakers have sought to push back, however, describing attacks on a range of ethically responsible business practices as “an attempt to manufacture a culture war and protect corporate special interests.”

Analysts expect the outcome of this year’s U.S. presidential election to determine whether the political backlash against ESG will have a deep and lasting effect.

“Obviously, the political environment in the U.S. is toxic, times 10 — and so people are going quiet. But one of the stats that I love is the biggest renewable power center in the United States is the state of Texas, right? Which is the state that has been leading the charge against pension fund managers who have a ‘woke’ agenda or whatever,” Winters told CNBC’s “Squawk Box Europe” on Friday.

“I mean, I do want to wake up one day and have a planet so if that makes me woke, shoot me.”

Green backlash

A pushback against climate policies is not just a U.S. issue. In Europe, indications of a green backlash — or “greenlash” — have started surfacing as businesses and citizens feel the costs of the energy transition.

When asked whether he was concerned about companies scaling back their sustainability commitments, Winters replied, “I don’t think there has been a big backing away.”

The CEO said his company had been “constantly refining” its net-zero methodology since setting a dual track of objectives in recent years.

The emerging markets-focused bank is aiming to reach net-zero carbon emissions within its own firm by 2025 and net zero in its financed emissions by 2050.

Signage atop the Standard Chartered Plc headquarters building, center, in Hong Kong, China, on Monday, Feb. 19, 2024.

Bloomberg | Bloomberg | Getty Images

“We said one, we’re going to be thought leaders and action leaders in terms of policies around net zero and our clients have completely engaged with us. We’ve seen no backing away from that at all,” Winters said.

“And second, we said we’re going to build a business to support our clients, and that business made $720 million last year, and we said it is going to make $1 billion next year. That’s not nothing. It’s a good business for us,” he said.

“If you don’t make a decent return on this business, you can’t keep on throwing resources at it, up to a point. This is not philanthropy. This is not political wokeness. This is do the right thing for the planet, do the right thing for your business. That’s what we’re doing, and I don’t see other people backing away from that.”

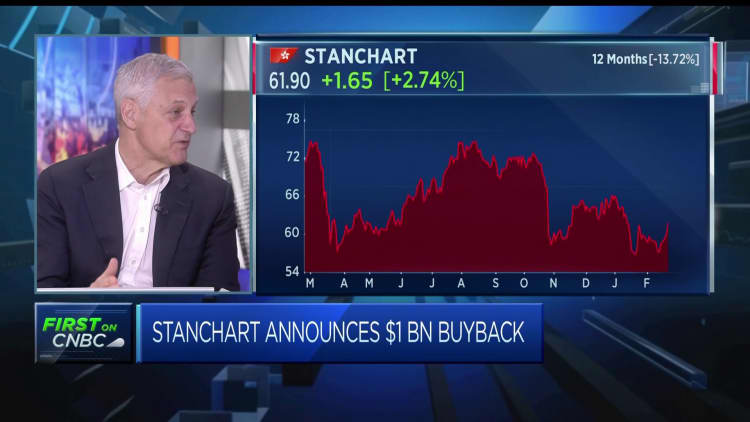

Shares of Standard Chartered are down around 3.8% year-to-date.

Read the original article here